1. MERGER

Merger comes from the word “merger” (Latin) which means:

– to merge, together, to unite in combination

– causing the loss of identity because something is absorbed or swallowed up

The definition of a merger is regulated in Article 1 number 9 of Law No. 40 of 2007 concerning Limited Liability Companies in conjunction with Article 109 number 1 of Law No. 6 of 2023 concerning Job Creation, which is a legal act carried out by one or more companies to merge with another existing company and subsequently the merging company ceases to exist.

Thus, a merger is one form of absorption by one company of another company. The larger-sized company continues to exist and retains its name and legal status, while the smaller-sized company ceases its activities or is dissolved.

In a merger, assets, including all assets owned by the company, and liabilities, including all obligations and capital of the merging company, are transferred entirely to the receiving company.

An example is the merger of Bank Danamon and Bank Duta. So, Bank Danamon is the receiving party of the merger and continues to exist, while Bank Duta is the merging party and ceases to exist after the merger. This results in Bank Danamon becoming larger, as it has taken over all the assets and liabilities of Bank Duta. Shareholders or owners of Bank Duta will still hold shares in the merged company (Danamon) through share exchange or substitution.

2. CONSOLIDATION

Consolidation is a specific form of merger where two or more companies come together to form a new entity. In the Limited Liability Company Law in conjunction with the Job Creation Law, consolidation is used interchangeably with the term “amalgamation” and is defined as follows:

“Amalgamation is a legal act carried out by two or more companies to merge themselves by forming a new company, and each company merging ceases to exist.”

In consolidation, the size of the company is not significant because all companies involved in the consolidation will cease to exist. This is different from a merger where the dominant company is usually retained. Consequently, the new company formed from consolidation will have new management formation, organizational structure, and capital structure. Then, the assets and liabilities of the merging companies will be transferred to the new company resulting from the consolidation.

An example of consolidation in the banking sector is the formation of Bank Mandiri. In 1998, four government-owned banks, namely Bank Bumi Daya, Bank Dagang Negara, Bank Ekspor Impor, and Bank Pembangunan Indonesia, were consolidated into Bank Mandiri with the aim of streamlining and enhancing the competitiveness of government-owned banks in the national banking industry.

3. ACQUISITION

3. ACQUISITION

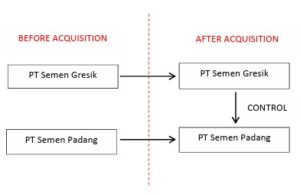

Based on Article 1 number 11 of the Limited Liability Company Law in conjunction with Article 109 number 1 of the Job Creation Law, acquisition is a legal act carried out by a legal entity or an individual to acquire either all or most of the shares of a company, which may result in a change of control over the company.

Acquisition is the takeover of ownership of a company, resulting in a transfer of control over the acquired company. The control referred to here is the power to:

- Regulate the financial and operational policies of the company

- Appoint and dismiss management

- Obtain a majority vote in board meetings.

With control, the acquirer will benefit from the acquired company. Acquisition does not result in the dissolution of the companies involved as legal entities, so they continue to exist and operate independently, but with control transferred to the acquirer. The acquiring company holds a majority of the voting shares, usually representing ownership of more than 50% of those voting shares. Additionally, the assets and liabilities of the acquired company remain with the entity whose shares have been acquired.

An example of an acquisition is when PT Semen Gresik acquired 100% of the shares of PT Semen Padang in 1995. Both companies remained separate legal entities, but the ownership of PT Semen Padang shifted to PT Semen Gresik. Consequently, PT Semen Gresik gained full control over PT Semen Padang’s policies regarding finance, management, marketing, production, and other strategic decisions.

If you require legal consultation, you may contact us through:

Email : Secretary@mnllaw.co.id

Phone : 081295397825 / 081398941976